Q1, 2024 Summary for Indemo: Empowering Investors Across Europe

Indemo has experienced remarkable growth and success in the first quarter of 2024, solidifying its position towards a leading investment platform in Europe. With a dedication to democratizing investing and offering accessible investment opportunities, Indemo has achieved significant milestones and garnered industry recognition.

To celebrate our achievements and keep you informed, we invite you to watch our latest YouTube video where we dive into our Q1 results.

Performance Highlights:

- Client Traction: Since its launch in November 2023, Indemo has experienced rapid client growth. In Q1 alone, over 200 users joined the platform across Europe, contributing to a total of 600 registrations since its inception. This significant milestone underscores the strong market interest and demand for Indemo's investment opportunities, highlighting the platform's broad appeal to a wide range of investors.

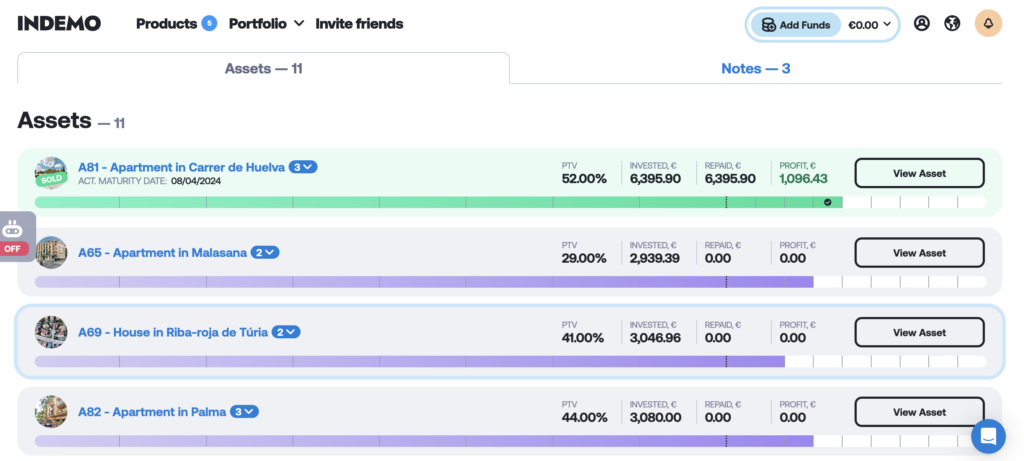

- Assets Under Management: As of December 31, 2023, Indemo's portfolio of notes (AUM) amounted to €1,162,884, which increased to €1,613,296 by March 31, 2024. During Q1, investors poured a total of €450,412 into notes, reflecting substantial investment activity. The number of funded notes stood at 23, while the number of debts in active offering was 13. This significant growth underscores the confidence and trust that investors have in the platform, with an impressive average investment of €7107 per client. Indemo's ability to offer attractive investment opportunities tailored to the diverse needs of its clientele is evident in these figures.

- Market Reach: Indemo's client base spans across over 13 countries in Europe, including key markets such as Germany, Spain, France, Portugal, and Latvia. This diverse and expansive reach speaks to Indemo's appeal on a pan-European scale, as well as its ability to cater to investors from various geographical regions. By establishing a presence in multiple countries, Indemo is well-positioned to capitalize on the growing demand for alternative investment options across Europe.

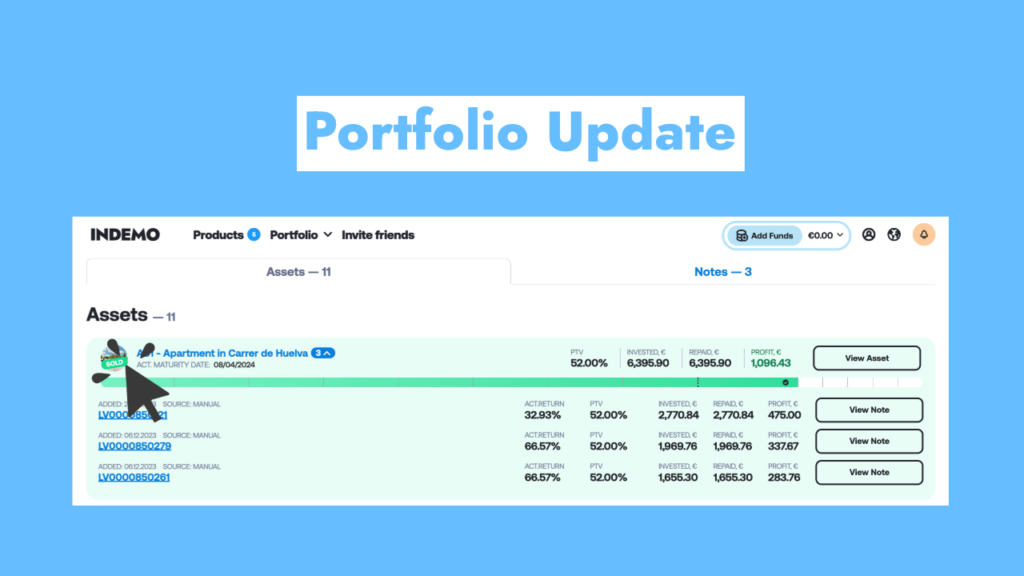

Interest Rates: In the early beginning of Q2, Indemo celebrated the closure of its first discounted debt cycle, marking a significant milestone for our beloved community of investors. This achievement is a testament to our commitment to innovation and our vision of empowering retail investors with unique investment opportunities.

Impact of First Debt Repayment on the Indemo Community:

The first debt repayment in April has had a substantial impact on our investor community, with 65% of investors experiencing its effects. This repayment generated EUR 246,000 in cash and involved thirty Notes funded on Indemo. The actual return on investment for investors' portfolios has ranged from 22% to an impressive 118% per annum, showcasing the tangible returns and value that Indemo brings to its community of investors.

Recognition and Achievements in Q1, 2024:

- EU-Startups Recognition: Indemo is proud to announce its inclusion in the prestigious list of top 10 promising Latvian startups by EU-Startups.com. This recognition highlights our dedication to enhancing Latvia's startup ecosystem and making significant strides in global entrepreneurship.

- Meetings at Estonia Toomas Event: Indemo participated in key meetings at the Estonia Toomas Event, fostering valuable connections and collaborations within the industry.

- Annual Financial Report for 2023: Indemo's annual financial report for 2023 underwent thorough auditing and has been officially published, demonstrating transparency and accountability to our stakeholders.

- Safeguarding Compliance Audit Check: We are pleased to announce that Indemo successfully passed the safeguarding compliance audit check, reaffirming our commitment to regulatory compliance and ensuring the security of our investors' funds.

- Investors Portfolio Quarterly Reports: In Q1, 2024, we introduced quarterly reports for our investors' portfolios, providing comprehensive insights and transparency into their investment performance and enhancing their overall experience with Indemo.

Community Engagement and Feedback:

Indemo values community feedback and actively engages with investors to refine its offerings continually. Recent enhancements include periodic reports and a dual look feature in the "My Notes/Portfolio" section, inspired by investor feedback, to provide deeper insights and a more user-friendly experience.

Disclaimer: The Q1 summary is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with financial professionals before investing.

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.