Spanish Real Estate: Solid Collateral Behind Discounted Debts

With over €15M in assets under management and a community of over 14,000 investors, Indemo has helped clients build diversified portfolios and benefit from discounted debts backed by real estate collateral. Since the appraisal and value of each property are critical for every debt placed on the platform, it’s worth exploring current trends in the Spanish real estate market to understand the strength and potential behind our investment product. In this article, we take a closer look at how Spain’s housing market has developed, what’s driving its current momentum, and how INDEMO is confident about opportunities that are present for our investor community.

Market Analysis: The State of Play in 2025

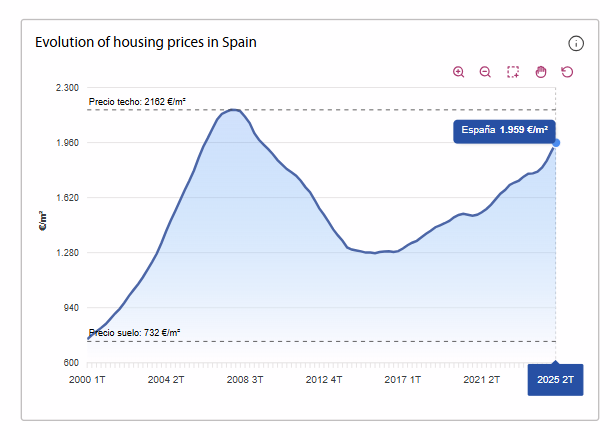

For the first time since Spain’s 2008 market peak, average property values are approaching historic highs. Back then, the market reached around €2,095 per square meter, a level that seemed untouchable for over a decade in the aftermath of the global financial crisis. In the first quarter of 2025, the national average had climbed to €2,033 (Banco de España) per square meter, bringing it very close to that historical record. This trajectory clearly positions today’s real estate market as the strongest Spain has seen in nearly two decades, underscoring why 2025 is emerging as one of the most strategic moments to access real estate-backed investments.

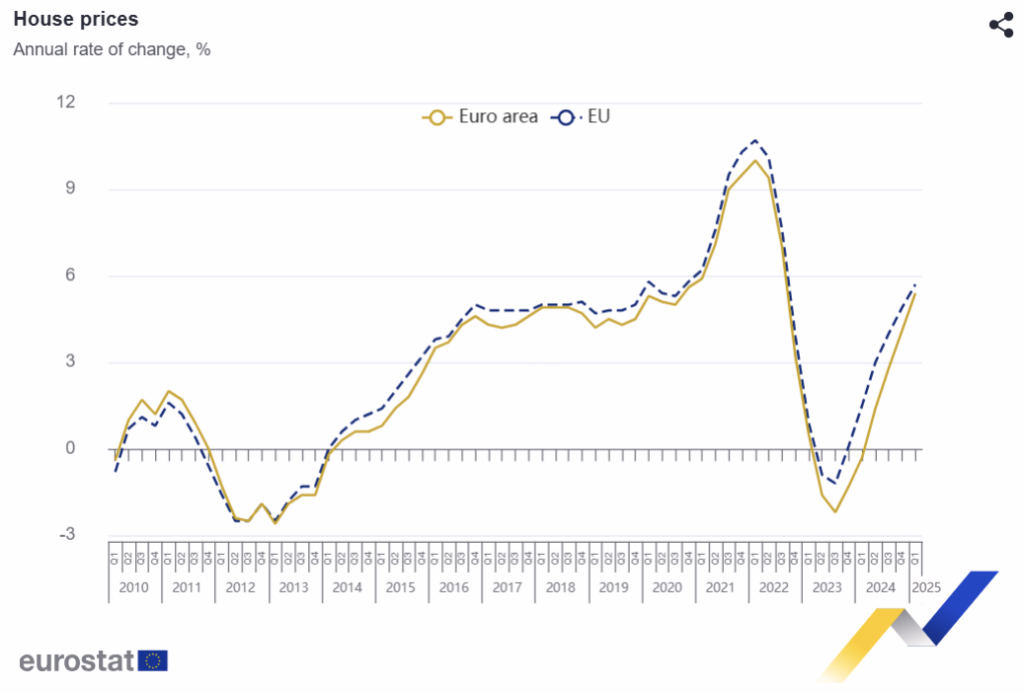

Spain’s housing market has shown remarkable acceleration from 2024 into 2025. In Q2 2024, prices were up 7.9% year-on-year, already indicating strong growth. This momentum intensified through the year: Q3 2024 saw an annual increase of 8.3%, followed by an even sharper rise of 11.4% in Q4 2024 (Eurostat).

According to Banco de España, Spain’s official house price index, residential property values increased by 12.2% year-on-year in the first quarter of 2025. This represents more than double the Eurozone average of 5.4% and well above the broader EU average of 5.7%, according to Eurostat. Among EU Member States, Finland recorded a decline (-1.9%), while the strongest growth was seen in Portugal (+16.3%), Bulgaria (+15.1%), and Croatia (+13.1%). Spain’s performance places it firmly among the top-performing markets in Europe, underscoring the scale of its current housing boom relative to regional peers.

However the Banco de España has not yet published its official HPI data for the second quarter, according to Tinsa, Spain’s leading real estate valuation firm, in Q2 average residential prices, covering both new and second-hand properties, reached €1,959/m² in Q2 2025, marking a year-on-year increase of approximately 10.0%.

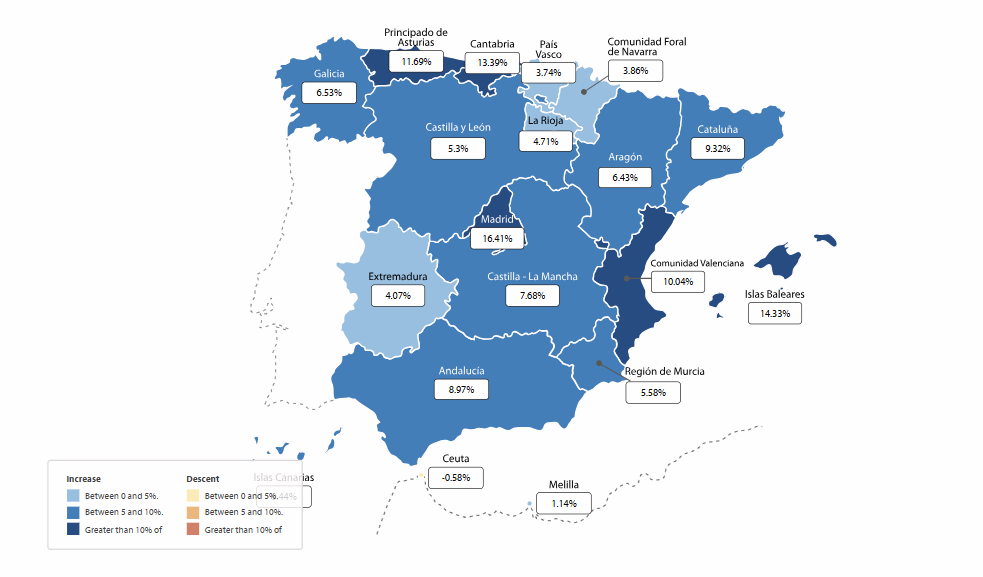

In comparison, Tinsa reported an 8% rise in Q1 (instead of 12,2% published by Banco de España). The IMIE Local Markets index, also produced by Tinsa, shows a nearly identical trend: +9.8% YoY growth, with a +2.6% rise over the previous quarter.

The differences in numbers may reflect methodological variations. While Banco de España relies on transaction data from INE, Tinsa provides valuation-based figures—but both point clearly to the same conclusion: Spain’s housing market continues to expand, confirming its resilience and attractiveness to investors.

Naturally, prices vary widely depending on the region, with the highest levels found in major capitals and coastal hubs. San Sebastián leads the ranking with an average of €4,527/m², followed closely by Madrid (€4,473/m²) and Barcelona (€4,117/m²). Other high-priced cities include Palma de Mallorca (€3,264/m²) and Bilbao (€2,943/m²), reflecting strong demand in both tourist destinations and economically dynamic urban centers. In Q2 2025 growth has been recorded across nearly all provinces, with the sole exception of the city of Ceuta.

The consistent upward trend illustrates how Spain has moved from steady post-pandemic recovery into a phase of sustained double-digit growth, setting it apart as one of the EU’s most dynamic housing markets. The double-digit growth captured in the HPI underscores the strong momentum of the market at the start of the year and provides a clear indication of the structural demand pressures driving Spanish real estate in 2025.

Market Expectations: Resilient Performance and Long-Term Value

According to CBRE’s Mid-year Real Estate Outlook España 2025, the Spanish property sector will continue to demonstrate resilience and broad-based growth. Residential prices are projected to rise by 9.6% in 2025, with transaction volumes reaching around 742,000 (+3.7%). Investment is also expanding beyond traditional segments, with strong momentum in Living assets such as affordable rental housing, student residences, and flex living, as well as in tourism-related assets, logistics, and alternative sectors including healthcare, education, and data centers. Despite a challenging global environment, Spain’s real estate market stands out for its capacity to attract capital and generate long-term value.

According to Statista estimates in 2025, the Real Estate market market in Spain is projected to reach a value of US$7.38tn. This sector is anticipated to grow at an annual growth rate of 2.73% (CAGR 2025-2029), resulting in a market volume of US$8.22tn by 2029.

Similarly, BBVA Research expects Spanish housing prices to maintain their upward trajectory, with average annual growth projected at around 6.5% for the next few years. The forecast suggests that the pace of appreciation will be slightly stronger in 2025 than in 2026, as the market begins to reflect a broader economic slowdown. This outlook reinforces the view that, despite cyclical adjustments, Spain’s real estate sector remains positioned for continued expansion in the near term.

What’s Driving this Growth?

Behind these numbers lies a set of powerful forces that continue to push Spain’s housing market forward. On the supply side, new construction simply isn’t keeping up with the pace at which new households are being formed. Even though permits are rising, completions remain limited creating a shortage that keeps increasing prices. At the same time, Spain’s labor market is strong, wages are growing, and the broader economy is forecast to expand by 2.6% in 2025, giving buyers more confidence to step into the market.

Demand is further amplified by international interest. Coastal hotspots such as the Balearic Islands, the Canary Islands, and the Costa del Sol continue to attract foreign capital, particularly from Northern Europe.

Moreover, with mortgage lending recovering after a slowdown during the period of higher interest rates (Banco de Espana) households now have greater access to financing than in recent years.

Discounted Debt Investments: A Smart Way to Access Spain’s Real Estate Boom

With housing prices climbing at their fastest pace in years, mortgage lending has regained strength, making discounted debt investments an increasingly compelling opportunity. By acquiring non-performing mortgage loans from Spanish banks at a significant discount, investors can benefit from assets whose market value is not only solid but also showing signs of growth.

With projected double-digit yields and strong collateral backing, discounted debts have become one of the most attractive ways to access the real estate market today. By combining solid collateral with a secure regulatory framework and up to €20,000 investor protection under the EU compensation scheme, Indemo positions itself as a trusted gateway for individuals seeking to benefit from Spain’s thriving real estate sector.

Don't miss out!

Explore existing offers on our platform, and don’t miss October’s CashbackFest program, which offers a limited-time bonus of up to 4% to maximize your investment.

👑 Special VIP Offer: Investors planning to invest €20,000 or more this month reach out to [email protected] for an exclusive cashback deal.

Stay informed on Indemo News by following our socials:

📢 Telegram - Exclusive Indemo Chat Content, where investors can connect directly with Indemo’s key stakeholders

📷 Instagram - Meet the team, Indemo Daily life, Special Promos

🎥 YouTube - Podcasts, Meet Indemo Experts, Quarterly Reviews

(Indemo Q3 review was released this week)

- Banco de España, Síntesis de Indicadores 2025

- House prices up by 5.4% in the euro area - Euro indicators - Eurostat

- Housing Price Spain 2025 | Real Estate Market Evolution

- IMIE Local Markets | Real Estate Appraisal Report

- Mid-year Real Estate Outlook España 2025: claves del mercado inmobiliario para la segunda mitad del año | CBRE Spain

- Real Estate - Spain | Statista Market Forecast

- Spain | Overview of a strained real estate market | BBVA Research

- Table of official mortgage market reference rates - Cliente Bancario, Banco de España

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.